A Complete Guide To Business Valuation Asset-based Approach

As an owner of a company, you’ll agree to the saying that frequent business valuations are essential for a firm no matter its size and scale.

You see, it is none but the report that the valuation expert prepares detailing the fair market value of your company that determines the asking price during mergers, acquisitions, and stake sales.

To determine the fair market value of your company a valuation expert deployed multiple methods and approaches. And among these approaches, the asset-based valuation method provides the most real-time date of how much is the worth of your business’s assets.

So what exactly is the asset-based approach to business valuation?

Simply speaking, the asset-based approach to business valuation will consider all the assets that your company holds, including tangible and intangible ones, and analyze all of them to figure out what their value on the market is.

To begin with, a valuation expert will conduct an analysis of all the tangible assets of your firm, and that includes the property, machinery, land, equipment etc. After this, a value will be assigned to each of them.

Thereafter, all the intangible assets of the company like trademarks, copyrights, patents, etc., will be thoroughly evaluated for the purpose of assigning a value to them.

Also, the forensic accountants will analyze even such assets which aren’t usually a part of the balance sheet. For example, the goodwill of your firm on the market will be evaluated since they’re also counted as part of intangible assets.

What are the benefits of business valuation via asset-based approach

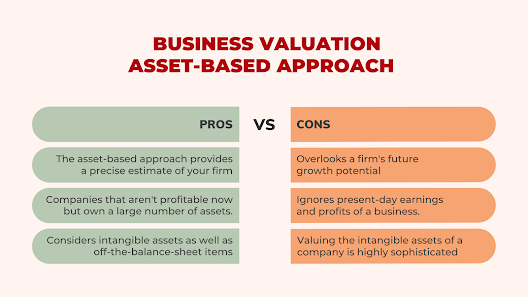

There are multiple ways in which the asset-based approach to company valuation comes in handy for a business.

Here are some amazing benefits of asset-based business evaluation services:

At the time of liquidation, acquisition, or merger, the asset-based calculation is the best approach to find out the current market value of your business.

It is the go-to method for companies that aren’t profitable in the present time but hold a large number of assets. Other valuation methods value less profitable firms much lower.

Other valuation methods overlook intangible assets during company valuation.

The final word

If a full-fledged forensic accounting of your firm un-influenced by the current economic situation is something you’re looking for, then an asset-based valuation should be your one-stop solution.

While it's true that the one-size-fits-all approach isn’t fit for business valuation, the asset-based approach has something in store for every firm/business.

Comments

Post a Comment